| (6) | These options were granted on August 11, 2009 and vest1/ 48 per month from date of grant. |

| (7) | These options were granted on May 13, 2010 and vest1/ 48 per month from date of grant. |

| (8) | These options were granted on August 10, 2010 and vest1/ 48 per month from date of grant. |

| (9) | These options were granted on December 14, 2010 and vest1/ 48 per month from date of grant. |

Three directors are full-time executive officers of the Company and receive no additional compensation for service as a director. Carl A. Bellini, Dennis H. Field, and Gerald J. Laber were in 2009 and are currently non-employee directors. Mr. Johnson was an executive officer until January 29, 2009 and is currently a non-employee director. The Company payspaid $2,250 per month (through November 30, 2009) to each non-employee director for his services as director. The Company through August of 2006Beginning December 2009, compensation paid each non-employee director $2,500 per month beginning in September 2006, as a cost cutting measure,to Messrs. Bellini, Field, and Johnson was reduced to $1,125 per month, while Mr. Laber’s compensation was reduced to $1,250 per month. The following table shows the annual and other compensation of the non-employee directors at December 31, 2010 for services to the Company reduced this amount by 10% resulting in monthly payments of $2,250.

| Non-Qualified | ||||||||||||||||||||||||||||

| Non-Equity | Deferred | |||||||||||||||||||||||||||

| Fees Earned | Stock | Option | Incentive Plan | Compensation | All Other | |||||||||||||||||||||||

| or Paid in Cash | Awards | Awards | Compensation | Earnings | Compensation | Total | ||||||||||||||||||||||

| Name | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (j) | |||||||||||||||||||||

| Each non-employee directors | 29,000 | — | — | — | — | — | 29,000 | |||||||||||||||||||||

DIRECTOR COMPENSATION FOR 2010 | ||||||||||||||||||||||||||||

Name (a) | Fees Earned or Paid in Cash ($) (b) | Stock Awards ($) (c) | Option Awards ($) (d)(1) | Non-Equity Incentive Plan Compensation ($) (e) | Non-Qualified Deferred Compensation Earnings ($) (f) | All Other Compensation ($) (g) | Total ($ ) (j) | |||||||||||||||||||||

Carl A. Bellini | 13,500 | — | 13,763 | — | — | — | 27,263 | |||||||||||||||||||||

Dennis H. Field | 13,500 | — | 3,824 | — | — | — | 17,324 | |||||||||||||||||||||

Gerald J. Laber | 15,000 | — | 8,753 | — | — | — | 23,753 | |||||||||||||||||||||

Jeffry B. Johnson | 13,500 | — | 24,469 | — | — | — | 37,969 | |||||||||||||||||||||

| (1) | Amounts shown in the column “Option Awards” are the aggregate grant date fair value of stock options granted in 2010, computed in accordance with ASC 718. For information on the valuation assumptions for the stock options, please refer to Note 1(n) of the Company’s Financial Statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010 as filed with the Securities and Exchange Commission on March 29, 2011, a copy of which accompanies this Proxy Statement. These amounts do not necessarily correspond to the actual value that may be recognized by the directors in the future. |

The following table summarizes information with respect to each non-employee director’s outstanding stock options at December 31, 2006:

| Outstanding Options at December 31, 2010 | ||||||||||||||||

Name | Number of Securities Underlying Unexercised Options # Exercisable | Number of Securities Underlying Unexercised Options # Unexercisable | Option Exercise Price $ | Option Expiration Date | ||||||||||||

Carl A. Bellini | 47,917 | (1) | 2,083 | 0.82 | Feb. 26, 2012 | |||||||||||

| 13,750 | (4) | 16,250 | 0.17 | Feb. 23, 2014 | ||||||||||||

| 4,688 | (5) | 25,312 | 0.22 | May 12, 2015 | ||||||||||||

| 5,156 | (6) | 49,844 | 0.23 | Aug. 9, 2015 | ||||||||||||

Dennis H. Field | 95,833 | (1) | 4,167 | 0.82 | Feb. 26, 2012 | |||||||||||

| 23,438 | (2) | 21,562 | 0.17 | Nov. 27, 2013 | ||||||||||||

| 2,344 | (6) | 22,656 | 0.23 | Aug. 9, 2015 | ||||||||||||

Gerald J. Laber | 28,750 | (1) | 1,250 | 0.82 | Feb. 26, 2012 | |||||||||||

| 13,750 | (4) | 16,250 | 0.17 | Feb. 23, 2014 | ||||||||||||

| 2,813 | (6) | 27,187 | 0.23 | Aug. 9, 2015 | ||||||||||||

| 313 | (7) | 29,687 | 0.20 | Dec. 13, 2015 | ||||||||||||

Jeffry B. Johnson | 15,525 | (1) | 675 | 0.82 | Feb. 26, 2011 | |||||||||||

| 29,750 | (3) | 12,250 | 0.55 | Feb. 25, 2013 | ||||||||||||

| 4,167 | (4) | 3,833 | 0.17 | Nov. 27, 2013 | ||||||||||||

| 12,500 | (5) | 67,500 | 0.22 | May 12, 2015 | ||||||||||||

| 4,688 | (6) | 45,312 | 0.23 | Aug. 9, 2015 | ||||||||||||

| 192 | (7) | 18,208 | 0.20 | Dec. 31, 2015 | ||||||||||||

| (1) | These options were granted on February 27, 2007 and vest1/ 48 per month from the date of grant. |

| (2) | These options were granted on November 28, 2008 and vest1/ 48 per month from the date of grant. |

| (3) | These options were granted on February 26, 2008 and vest1/ 48 per month from the date of grant. |

| (4) | These options were granted on February 24, 2009 and vest1/ 48 per month from the date of grant. |

| (5) | These options were granted on May 13, 2010 and vest1/ 48 per month from the date of grant. |

| (6) | These options were granted on August 10, 2010 and vest1/ 48 per month from the date of grant. |

| (7) | These options were granted on December 14, 2010 and vest1/ 48 per month from the date of grant. |

PROPOSAL 2: AMENDMENT TO STOCK INCENTIVE PLAN

Amendment

The Company’s Board amended on March 16, 2011, the Company’s 2005 Stock Incentive Plan (the “2005 Plan”) to increase the number of shares of common stock available under the 2005 Plan by 1,500,000 shares of common stock, for a total authorized number of 3,000,000 shares. The amendment increasing the number of shares under the 2005 Plan is subject to approval of the Company’s shareholders and is included asAppendix A hereto. The effective date of the amendment will be the date of shareholder approval.

Prior to the amendment, 1,500,000 shares have been available under the 2005 Plan. After the amendment, the total number of shares available under the 2005 Plan will be 3,000,000 shares. The reasons for the amendment to the 2005 Plan include:

| Outstanding Options at December 31, 2006 | ||||||||||

| Number of Securities | Number of Securities | |||||||||

| Underlying Unexercised | Underlying Unexercised | Option | ||||||||

| Options | Options | Exercise | Option | |||||||

| # | # | Price | Expiration | |||||||

| Name | Exercisable | Unexercisable | $ | Date | ||||||

| Carl A. Bellini | 50,000 | — | 0.57 | February 18, 2007 | ||||||

| 30,000 | — | 0.54 | May 4, 2010 | |||||||

| 30,000 | — | 0.60 | August 22, 2010 | |||||||

| 25,000 | — | 0.60 | August 22, 2010 | |||||||

| Dennis H. Field | 100,000 | — | 0.57 | February 18, 2007 | ||||||

| 45,000 | — | 0.62 | November 27, 2008 | |||||||

| 25,000 | — | 0.60 | August 22, 2010 | |||||||

| Gerald J. Laber | 30,000 | — | 0.76 | February 25, 2009 | ||||||

| 30,000 | — | 0.60 | August 22, 2010 | |||||||

| 30,000 | — | 0.96 | December 13, 2010 | |||||||

The Company’s Board believes that the Company must have available and grant options to employees in order to retain employees in a competitive environment, particularly employees who are subject to the Company’s salary and wage freeze.

13

The 2005 Plan is the only stock plan of the Company’s under which grants may be made.

The increase in options is intended in part to replace options which expire, without being exercised, under the Company’s 1997 Stock Option Plan and 1998 Stock Option Plan. See “Shares Under All Plans as of March 31, 2011” below. Stock options issued under the 1997 and 1998 Plans remain outstanding after the expiration of those Plans and continue for the term of the options, which has typically been five years from the date of grant. The amendment will subtract from the total number of shares available under the 2005 Plan the number of shares which are actually issued under the 1997 and 1998 Plans.

Options reward persons who have stayed with the Company.

Options provide an incentive on the part of officers and other employees, as well as directors, to improve the Company’s performance.

The grant of options aligns the goals of the optionees with those of the shareholders.

The options provide to directors and executive officers a meaningful stake in the Company.

Shares Under All Plans As of March 31, 2011

The Company currently has outstanding options under three stock option plans. They are the 1997 Stock Option Plan (for which the executive officers and directors are ineligible), the 1998 Stock Option Plan and the 2005 Plan. The number of shares available under the Plans are shown in the following table:

| 2005 Plan(3) | ||||||||||||||||

| 1997 Plan | 1998 Plan | With Amendment | Total | |||||||||||||

Shares authorized for future issuances | — | — | 3,000,000 | (1)(2) | 3,000,000 | (1)(2) | ||||||||||

Shares subject to outstanding options | 240,500 | 296,900 | 1,396,150 | 1,933,550 | ||||||||||||

Shares previously issued upon exercise of options | — | 22,000 | 3,500 | 25,500 | ||||||||||||

Shares available for option grants | 1,600,350 | 1,040,950 | (2) | |||||||||||||

| (1) | Includes 1,500,000 shares added by the amendment being submitted to the shareholders for approval. |

| (2) | The number of shares under the 2005 Plan is decreased by options exercised under the 1997 and 1998 Plans after May 6, 2008. |

| (3) | Expires on March 31, 2015. |

Significant features of the 2005 Plan are summarized below, as currently in effect and as the 2005 Plan will be in effect after the amendment which solely increases the number of shares available for awards. This summary is qualified in its entirety by reference to the full text of the 2005 Plan which is available from the Company and is an exhibit to filings with the SEC.

General

In March, 2005, the Company’s Board adopted the 2005 Plan, subject to approval and ratification by shareholders. The shareholders approved the 2005 Plan in May 2005. The shareholders approved an amendment to increase the number of shares available under the 2005 Plan from 900,000 to 1,500,000 on plans under which non-employee directorsMay 6, 2008.

The 2005 Plan provides that the 2005 Plan administrator may receiveissue stock awards consisting of incentive and non-qualified stock options, stock appreciation rights, restricted stock and restricted stock units. The 2005 Plan administrator may grant one or more of these types of awards. The Board will administer the 2005 Plan unless the Board delegates the administration of the 2005 Plan to a committee, which will be appointed by and serve at the pleasure of the Board. The 2005 Plan administrator determines and designates from time to time (a) those eligible persons to whom awards are granted, (b) the size, form, terms (including vesting, if any) and conditions of awards under the 2005 Plan and (c) rules with respect to the administration of the 2005 Plan. The 2005 Plan administrator may at any time cancel an award, whether vested or unvested, if the participant engages in conduct that the 2005 Plan administrator determines to be detrimental to the best interest of the Company, including failure to comply with policies or procedures of the Company.

Shares Subject to 2005 Plan; Limitations

The aggregate number of shares of Common Stock that may be issued under awards granted pursuant to the 2005 Plan will be 3,000,000 shares of the Company’s common stock, less the number of shares issued as a result of the exercise of options under the 1997 and 1998 Plans, after May 6, 2008. If there is a stock dividend, subdivision, reclassification, recapitalization, merger, consolidation, stock split, combination or exchange of stock, or other event described under the terms of the 2005 Plan, the administrator will make appropriate adjustments to the total number of shares available under the 2005 Plan and to outstanding awards. If an outstanding award expires or ceases to be exercisable, the shares that were subject to the award will continue to be available under the 2005 Plan.

During any single calendar year, no participant will be eligible to be granted awards exceeding 10% of the limit on shares under the 2005 Plan. From March, 2005 to the date on which the 2005 Plan terminates, no participant will be eligible to be granted awards exceeding 20% of the limit on shares.

Term of 2005 Plan

The 2005 Plan was effective as of March 31, 2005. The 2005 Plan will terminate on March 31, 2015, unless terminated earlier by the Board. Termination of the 2005 Plan will not affect grants made prior to termination.

Eligibility

All full-time and part-time employees are eligible to receive any award under the 2005 Plan. Directors and consultants of the Company and its subsidiaries, who are not employees, are eligible to receive any award, other than incentive stock options, under the 2005 Plan.

Securities Issuable Under the 2005 Plan

Stock Options

The exercise price for an option granted under the 2005 Plan must not be less than 100% of the fair market value of the shares subject to the option at the date of grant. No option will be repriced. The term of each option may not be more than ten years from the date of grant. An option is fully vested unless otherwise provided by the 2005 Plan administrator in the option agreement. A participant may pay the exercise price and withholding taxes in cash or, upon approval of the 2005 Plan administrator, in common stock of the Company or another form of legal consideration. No incentive stock option may be granted to an employee who, at the time the incentive stock option is granted, owns stock (as determined in accordance with the Internal Revenue Code) representing more than 10% of the total combined voting power of all classes of stock of the Company or of any parent or subsidiary, unless the option price of such incentive stock option is at least 110% of the fair market value of the stock subject to the incentive stock option and the incentive stock option by its terms is not exercisable more than five years from the date it is granted.

Stock Appreciation Rights

A stock appreciate right, or SAR, is exercisable for the receipt of a number of shares of common stock having a fair market value equal to (1) the fair market value on the date of exercise of the number of shares as to which the SAR has been exercised over (2) the aggregate exercise price of the SAR for such number of shares. The exercise price for each SAR will be no less than the fair market value of the common stock at the time the SAR is granted. No SAR will be repriced. The term of any SAR may not

exceed ten years from the date of grant. SARs will be fully vested unless otherwise determined by the 2005 Plan administrator and stated in a stock appreciation rights agreement.

Restricted Stock and Restricted Stock Units

Restricted stock may be granted to a participant without the payment of a purchase price. If a grant of restricted stock requires the payment of a purchase price, the purchase price of the restricted stock may not be repriced. If restricted stock has a purchase price, a participant must pay the purchase price in cash or, upon approval of the 2005 Plan administrator, in common stock or another form of legal consideration. If a participant fails to satisfy any applicable restriction (including vesting requirements) on the restricted stock, the restricted stock will be forfeited to the Company in return for no consideration or such consideration as specified in the applicable award agreement. Restricted stock constitutes issued and outstanding shares of common stock for all corporate purposes. The participant will have the right to vote the restricted stock, to receive and retain all regular cash dividends and such other distributions as the Board may, in its discretion, pay on the common stock, and to exercise all other rights, powers and privileges of a holder of common stock.

A restricted stock unit represents an obligation of the Company to deliver a specific number of shares of common stock to the participant on a specified date. Any award of restricted stock or an RSU will be fully vested or will vest in accordance with a vesting schedule provided in the agreement for that award as determined by the 2005 Plan administrator.

Valuation

For purposes of the 2005 Plan, the fair market value of common stock optionsmeans the average of the closing sales prices for the common stock on its trading market for the five preceding trading days as reported in The Wall Street Journal or another publication or source for market prices selected by the Board. If there has not been trading of the common stock on a specific day, then a trading day is the next preceding day on which there was such trading. If closing sales prices are not available for the trading market, the average of the closing bid and asked prices are used. If none of these alternatives are available, the 2005 Plan administrator will determine the fair market value by applying any reasonable valuation method.

Change in Control

If a change in control event occurs, then the vesting of all awards held by participants in continuous service at the time will be accelerated in full. In anticipation of a change in control event, the 2005 Plan administrator may require that all unexercised awards be exercised upon the change in control event or within a specified number of days of the change in control. The 2005 Plan administrator may in its discretion also accelerate the vesting of any outstanding award in connection with any proposed or completed change in control event, and prior to non-employee directorsa change in February 2007, please see “Stock Plans” above.

Termination of Continuous Service

Any vesting of an award ceases upon termination of a participant’s service with the Company. A stock option or SAR will terminate and may not be exercised after three months after a participant’s

service with the Company ceases for any reason other than cause, disability or death. If a participant ceases service with the Company for cause or if the participant breaches any covenant not to compete or non-disclosure agreement, an unexercised stock option or SAR shall terminate immediately. If a participant ceases their service with the Company due to death or disability, an outstanding stock option or SAR will be exercisable for one year after that time but not later than the expiration date of the award. The 2005 Plan administrator may in its discretion extend the dates for termination of awards as stated in this paragraph.

If a participant terminates service with the Company for any reason, any unvested restricted stock or unvested RSUs held by the participant as of the date of termination of service will be forfeited to the Company unless otherwise provided in an applicable award agreement.

Amendment of 2005 Plan

The Board may at any time and from time to time alter, amend, suspend or terminate the 2005 Plan or any part thereof as it may deem proper, except that no such action can diminish or impair the rights under an award previously granted. However, approval of the shareholders shall be required to increase the total number of shares issuable under the 2005 Plan, to reduce the exercise price for any option, SAR or RSU or the purchase price for any restricted stock below a level required by the 2005 Plan or to modify materially requirements for eligibility under the 2005 Plan. The 2005 Plan administrator may modify, extend or renew outstanding awards except that this action must not diminish or impair the rights of a previously granted award without the consent of the participant.

Federal Income Tax Consequences

The rules governing the tax treatment of stock awards granted under the 2005 Plan depend largely on the surrounding facts and circumstances. Generally, under current federal income tax laws, a participant will recognize income, and the Company will be entitled to a deduction as follows:

Stock Options

If an employee does not dispose of the shares acquired pursuant to the exercise of an incentive stock option within one year after the transfer of the shares to the participant and within two years from the grant of the option, the employee will not realize taxable income as a result of the grant or exercise of the option (except for purposes of the alternative minimum tax upon the exercise of the option), and any gain or loss that is subsequently realized may be treated as a long term capital gain or loss, depending on the circumstances. The Company will not be able to deduct any amount for the grant of the incentive stock option or the transfer of shares upon exercise. If the employee disposes of the stock prior to one year after the transfer of the shares (or two years prior to the option grant date), the participant will realize ordinary income in an amount equal to the lesser of (a) the excess of the fair market value of the common stock acquired on the date of exercise over the exercise price or (b) the gain recognized on such disposition. Upon the exercise of a nonqualified stock option, the participant will generally realize ordinary income equal to the excess of the fair market value of the shares on the date of exercise over the exercise price. The Company will be able to deduct an amount equal to the ordinary income realized by the participant.

Restricted Stock

A participant who receives an award of restricted stock will realize ordinary income (on a per share basis) at the time any restrictions lapse equal to the difference between the fair market value of the common stock at the time such restrictions lapse and the amount (if any) paid for the stock. Alternatively,

under Section 83 of the Internal Revenue Code, the participant may elect to accelerate the tax event and realize ordinary income (on a per share basis) equal to the difference between the purchase price (if any) of the common stock and the fair market value of the common stock on the date of grant upon the receipt of an award of restricted stock. When the participant recognizes ordinary income, the Company will be able to deduct an amount equal to the ordinary income recognized by the participant.

Restricted Stock Units

A participant who is granted an RSU will generally not recognize any income upon the grant of the award. The participant will generally recognize as ordinary income an amount equal to the fair market value of any shares transferred to the participant upon the vesting of such award. The Company will ordinarily be entitled to a deduction, in the amount of the ordinary income recognized by the participant, at the same time the participant recognizes such income, so long as the amount constitutes reasonable compensation.

Stock Appreciation Rights

Upon the exercise of any SAR, the value of any stock received will constitute ordinary income to the participant equal to the fair market value of the shares transferred to a participant upon the exercise. The Company will ordinarily be entitled to a deduction in the same amount and at the same time, so long as the amount constitutes reasonable compensation.

Section 409A

Section 409A, a section added to the Code in 2004, can affect the tax treatment of certain types of deferred compensation. Failure to comply with the requirements of Section 409A results in current income of amounts deferred, along with interest and a significant tax penalty. Certain types of equity-based compensation are exempt from Section 409A. The Company intends to operate the 2005 Plan so that all grants under the 2005 Plan are exempt from Section 409A.

Amendment Benefits

As of the date of this Proxy Statement, no executive officer, employee, director or consultant has been granted any award based upon the proposed amendment to the 2005 Plan. The benefits to be received by the eligible participants pursuant to the proposed amendment to the 2005 Plan are not determinable at this time.

Other Equity Compensation Plan Information

The following table provides, as of December 31, 2010, information regarding the Company’s equity compensation plans. The Company also has an Employee Stock Ownership Plan which invests only in common stock of the Company, but which is not included in the table below.

Plan Category

| Number of Securities to be issued upon exercise of outstanding options, warrants and rights (a)

| Weighted average exercise price of outstanding options, warrants and rights (b)

| Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c)

| |||

| Equity compensation plans approved by security holders | 1,933,550 | $0.39 | 100,350 | |||

| Equity compensation plans not approved by security holders | __ | __ | __ | |||

Total | 1,933,550 | $0.39 | 100,350 |

Vote required and Recommendation

The approval of the amendment to the 2005 Plan requires a majority of shares present and voting at the Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE AMENDMENT TO THE 2005 PLAN.

The Company has indemnification agreements with each of its directors and executive officers. These agreements provide for indemnification and advancement of expenses to the full extent permitted by law in connection with any proceeding in which the person is made a party because the person is a director or officer of the Company. They also state certain procedures, presumptions and terms relevant to indemnification and advancement of expenses.

Section 16(a) of the Securities Exchange Act of 1934 requires directors, executive officers and beneficial owners of more than 10% of the outstanding shares of the Company to file with the Securities and Exchange CommissionSEC reports regarding changes in their beneficial ownership of shares in the Company. To the Company’s knowledge, based solely upon review of Forms 3, 4 and 5, and amendments thereto furnished to the Company, there was full compliance with all Section 16(a) filing requirements applicable to those persons for reports filed in 2006.

General

Ehrhardt Keefe Steiner & Hottman PC, has been selected by the Audit Committee of the Board of Directorsan independent registered public accounting firm, served as the Company’s independent auditors for the fiscal year ended December 31, 2007.2010 and has been selected by the Audit Committee of the Board as the Company’s independent auditors for the fiscal year ending December 31, 2011. Ehrhardt Keefe Steiner and& Hottman PC has been the Company’s independent auditors since June 2003. A representative of Ehrhardt Keefe Steiner & Hottman PC is expected to be present at the Annual Meeting of Shareholders and to have the opportunity to make a statement if the representative so desires. Such representative also is expected to be available to respond to appropriate questions at that time.

14

March 16, 2011

To the Board of Directors of Scott’s Liquid Gold-Inc.:

We have reviewed and discussed with management the Company’s audited financial statements. We have discussed with Ehrhardt Keefe Steiner & Hottman PC, its independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61,114,The Auditors’ Communication with Audit Committees,Those Charged with Governance.as amended, by the Auditing Standards Boardadopted in a rule of the American Institute of Certified Public Accountants.Company Accounting Oversight Board (“PCAOB”). We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1,Independence Discussionsapplicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committees,as amended, by the Independence Standards Board,Committee concerning independence and have discussed with the auditors the auditors’ independence.

Based on the reviews and discussions referred to above, we recommendrecommended to the Board of Directors that the audited financial statements referred to above be included in the Company’s Annual Report on Form 10-KSB10-K for the year ended December 31, 20062010 and filed with the Securities and Exchange Commission.

The Audit Committee is composed of the three directors named below, all of whom are independent directors as defined in Rule 4200(a)(15) of the NasdaqNASDAQ Stock Market listing standards.

The Board has adopted a written charter for the Audit Committee.

Submitted by the members of the Audit Committee of the Board of Directors.

Gerald J. Laber, Chairman

Carl A. Bellini

Dennis H. Field

The preceding information under the caption “Report of the Audit Committee” shall be deemed to be “furnished” but not “filed” with the Securities and Exchange Commission.

15SEC.

The following is a description of the fees billed to the Company by its independent auditor (Ehrhardt Keefe Steiner & Hottman PC) for each of the years ended December 31, 20062010 and 2005.

| Audit and Non-Audit Fees | 2006 | 2005 | ||||||

| Audit fees | $ | 54,018 | $ | 47,607 | ||||

| Audit-related fees | 31,922 | 34,620 | ||||||

| Tax fees | 2,000 | 1,800 | ||||||

| All other fees | 10,956 | 15,470 | ||||||

Total | $ | 98,896 | $ | 99,497 | ||||

| Audit and Non-Audit Fees | 2010 | 2009 | ||||||

Audit fees | $ | 60,693 | $ | 60,184 | ||||

Audit-related fees | 1,185 | 1,185 | ||||||

Tax fees | 2,523 | 2,500 | ||||||

All other fees | — | — | ||||||

Total | $ | 64,401 | $ | 63,869 | ||||

Audit fees are for the audit of the Company’s annual financial statements and the review of the Company’s Annual Report on Form 10-K.10-K and the quarterly reviews of the financial statements included in the quarterly reports on form 10-Q. Audit-related fees include review of the Company’s interim financial statements and Forms 10-Q, required review of certain filings with the SEC, and issuance of consents, and review of correspondence between the Company and the SEC.SEC and services concerning internal controls and transactions. Tax fees primarily include tax compliance, tax advice, including the review of, and assistance in the preparation of, federal and state tax returns. All other fees in 2006 relate to audit of the three employee benefit plans of the Company.

Policy on Pre-Approval of Audit and Non-Audit Services

The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by the independent public accountants. Pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services. The Audit Committee has delegated limited pre-approval authority to its chairperson. The chairperson is required to report any decisions to pre-approve such services to the full Audit Committee at its next meeting.

Shareholder proposals for inclusion in the Company’s proxy materials relating to the next annual meeting of shareholders must be received by the Company on or before November 30, 2007.December 24, 2011. Also, persons named in the proxy solicited by the Board of Directors of the Company for its year 20082011 annual meeting of shareholders may exercise discretionary authority on any proposal presented by a shareholder of the Company at that meeting if the Company has not received notice of the proposal by February 12, 2008.

Shareholders who wish to obtain, without charge, a copy of the Company’s Annual Report on Form 10-KSB report10-K for the year ended December 31, 20062010 in the form filed with the Securities and Exchange CommissionSEC should address a written request to Dennis P. Passantino, Corporate Secretary, Scott’s Liquid Gold-Inc., 4880 Havana Street, Denver, Colorado 80239. The Company’s annual report to shareholders consists of suchForm 10-KSB and accompanies this proxy statement.

16

The Company will pay the cost of soliciting proxies in the accompanying form. In addition to solicitation by mail, proxies may be solicited by officers and other regular employees of the Company by telephone, telegraph or by personal interview for which employees will not receive additional compensation. Arrangements also may be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to beneficial owners of the shares held of record by such

persons, and the Company may reimburse such persons for reasonable out-of pocket expenses incurred by them in so doing.

As of the date of this Proxy Statement, Managementmanagement was not aware that any business not described above would be presented for consideration at the meeting. If any other business properly comes before the meeting, it is intended that the shares represented by proxies will be voted in respect thereto in accordance with the judgment of the persons voting them.

The above Notice and Proxy Statement are sent by order of the Board of Directors.Board.

/s/ Jeffrey R. Hinkle |

Jeffrey R. Hinkle Corporate Secretary |

Denver, ColoradoMarch 28, 2007

17

April 20, 2011

Form of Amendment to 2005 Stock Incentive Plan

1. Recitals. Pursuant to corporate resolution and subject to shareholder approval, Scott’s Liquid Gold-Inc. wishes to amend the Scott’s Liquid Gold-Inc. 2005 Stock Incentive Plan (the “Plan”) by increasing by 1,500,000 the number of shares available under the Plan from 1,500,000 shares to 3,000,000 shares.

2. Amendment of Plan. The following amendment to the Plan is adopted, effective as provided in Paragraph 3 below:

The Plan is hereby amended to revise the first sentence of Section 4.1 of the Plan to read in its entirety as follows:

| 4.1 | Plan Limit. Subject to the provisions of Section 4.4, the aggregate number of shares of Common Stock that may be issued under Awards granted pursuant to the Plan shall not exceed 3,000,000 shares, less the number of shares issued after May 6, 2008 as a result of the exercise of stock options under the 1997 Stock Option Plan and the 1998 Stock Option Plan of the Company. |

3. Effective Date. The Effective Date of this Amendment shall be the date on which the shareholders approve this amendment.

4. Terms and Conditions of Plan. Except for the amendment in paragraph 2, all terms and conditions of the Plan are unamended and shall remain in full force and effect.

5. Execution. Scott’s Liquid Gold-Inc. has executed this Amendment as of the date set forth below.

SCOTT’S LIQUID GOLD-INC. COMPANY | ||

By: | ||

COMPENSATION COMMITTEE CHARTER

April 2011

RESOLVED, that there is hereby established a Compensation Committee of the Board of Directors and that the members of the Compensation Committee shall consist of at least two or more outside Directors of the Company and, in addition, the Chairman ofas determined by the Board of the Company, but with the Chairman of the Board not being a voting member of the Committee;

RESOLVED, that the Compensation Committee of the Board of Directors shall have the following authority and responsibilities:

1. To developreview the development of an executive compensation philosophy for the Company; and to obtain all relevant data and information to perform its functions, including the retention of outside consultants at the Company’s expense, if necessary;

2. To originatereview all executive compensation proposals, including recommendations as to salaries, bonuses, determinations of stock grants under various stock plans and other executive benefits and perquisites;

3. To review the duties and responsibilities of the executive officers over time; and to recommend adjustments to compensation of executive officers up or down as appropriate;

4. To review the appropriate mix of variable versus fixed compensation for the Company’s executives and to make recommendations on this issue, as appropriate;

5. To review the Company’s bonus and other long-term incentive plans and to determine if procedures followed historically are the most effective;

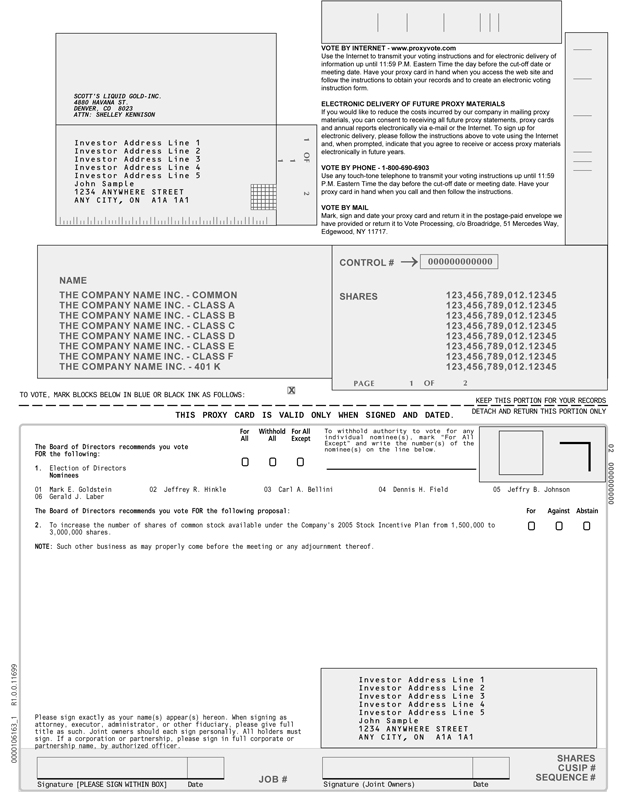

SCOTT’S LIQUID GOLD-INC. 4880 HAVANA ST.

DENVER, CO 8023 ATTN: SHELLEY KENNISON

1 |

Investor Address Line 1 Investor Address Line 2 Investor Address Line 3 1 1 OF Investor Address Line 4 Investor Address Line 5 John Sample 1234 ANYWHERE STREET 2 ANY CITY, ON A1A 1A1

NAME

THE COMPANY NAME INC.—COMMON THE COMPANY NAME INC.—CLASS A THE COMPANY NAME INC.—CLASS B THE COMPANY NAME INC.—CLASS C THE COMPANY NAME INC.—CLASS D THE COMPANY NAME INC.—CLASS E THE COMPANY NAME INC.—CLASS F THE COMPANY NAME INC.—401 K

x

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

VOTE BY INTERNET—www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To consider, subjectsign up for electronic delivery, please follow the instructions above to approval byvote using the wholeInternet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY PHONE—1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

CONTROL # 000000000000

SHARES 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345

PAGE 1 OF 2

KEEP THIS PORTION FOR YOUR RECORDS

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

DETACH AND RETURN THIS PORTION ONLY

For Withhold For All

To withhold authority to vote for any

All

All

Except

individual nominee(s), mark “For All

Except” and write the number(s) of the

The Board of Directors and/recommends you vote

nominee(s) on

the line below.

02

FOR the following:

0

0

0

1. Election of Directors

Nominees

01 Mark E. Goldstein 02 Jeffrey R. Hinkle 03 Carl A. Bellini 04 Dennis H. Field 05 Jeffry B. Johnson

06 Gerald J. Laber 0000000000

The Board of Directors recommends you vote FOR the following proposal:

For

Against

Abstain

2. To increase the number of shares of common stock available under the Company’s 2005 Stock Incentive Plan from 1,500,000 to

0

0

0 3,000,000 shares.

NOTE: Such other business as may properly come before the meeting or any adjournment thereof.

Investor Address Line 1 Investor Address Line 2 R1.0.0.11699

Investor Address Line

3

Investor Address Line

4

Investor Address Line

5

1 Please sign exactly as your name(s) appear(s) hereon. When signing as

_

John Sample

attorney, executor, administrator, or other fiduciary, please give fulltitle as such. Joint owners should each sign personally. All holders must

1234 ANYWHERE

STREET

sign. If a corporation or partnership, please sign in full corporate or

ANY CITY, ON

A1A 1A1

partnership name, by authorized officer.

0000106163

SHARES

CUSIP #

JOB #

SEQUENCE #

Signature [PLEASE SIGN WITHIN BOX]

Date

Signature (Joint Owners)

Date

0000106163_2 R1.0.0.11699

Important Notice Regarding the shareholders where necessary and appropriate, any request or proposalAvailability of Proxy Materials for any loanthe Annual Meeting: The Notice & Proxy Statement, Annual Report is/

are available at www.proxyvote.com .

SCOTT’S LIQUID GOLD-INC.

Annual Meeting of Shareholders

May 18, 2011 9:00 AM

This proxy is solicited by the Company to directors, officers or other insidersBoard of the Company; and

18

| ||||

adjournment thereof.

The shares of stock you hold in your account will be voted as you specify on the reverse side.

If no choice is specified, the proxy will be voted “FOR”“FOR” Item 1.

By signing the proxy, you revoke all prior proxies and appoint Mark E. Goldstein, and Jeffrey R. Hinkle Jeffry B. Johnson and Dennis P. Passantino, and each of them acting in the

absence of the others, with full power of substitution, as your proxies to vote all your shares on the matters shown on the reverse side and

any other matters which may come before the Annual Meeting and all adjournments.

Continued and to be signed on reverse for voting instructions.

side

| 1. | Election of directors: | 01 | Mark E. Goldstein | 05 | Carl A. Bellini | Vote FOR | Vote WITHHELD | |||||||||||||||

| 02 | Jeffrey R. Hinkle | 06 | Dennis H. Field | o | all nominees | o | from all nominees | |||||||||||||||

| 03 | Jeffry B. Johnson | 07 | Gerald J. Laber | (except as marked) | ||||||||||||||||||

| 04 | Dennis P. Passantino |